WE OFFER VENDOR LIABILITY INSURANCE IF YOUR VENDOR DOES NOT CARRY VENDOR LIABILITY INSURANCE.

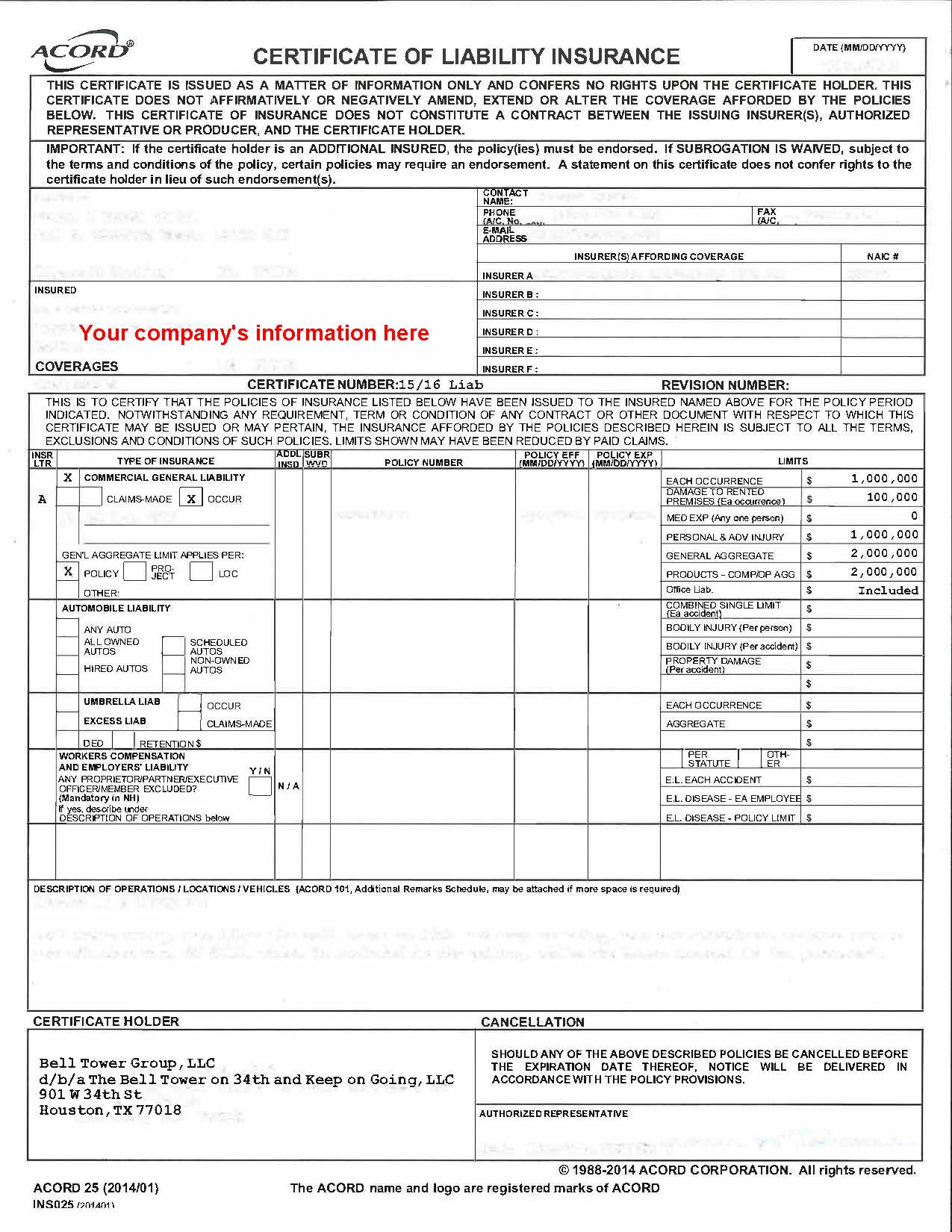

All vendors are required to provide a certificate of liability insurance naming:

Bell Tower Group, LLC d/b/a The Bell Tower on 34th and Keep on Going, LLC 901 W 34th St. Houston, TX 77018

as additional insured with a waiver of subrogation and containing a minimum limit of $1,000,000 per occurrence and $2,000,000 in the aggregate, at least two weeks prior to event date.

Below is a sample of the certificate of liability insurance.

Understanding Liability Insurance

You can rest assured that while we carry insurance for our venue, we also recognize the great importance of vendor insurance for events.

That means we carry event venue insurance, and we work to ensure that each vendor at events here has insurance.

Below are answers to common questions about event insurance, liability insurance, and event insurance cost considerations.

What is vendor liability insurance?

-This kind of insurance protects the vendor—and you—if they’re found liable for anything that goes wrong, from injuries to property damage, at your event. The insurance will cover the cost of damages awarded in a lawsuit.

What is a waiver of subrogation for wedding insurance?

-A Waiver of Subrogation is an endorsement to your event policy. It prevents an insurance company from seeking compensation for paid claims from a venue’s insurance policy.

What is liquor liability insurance?

-This kind of policy offers protection against the financial consequences of third-party property damage and bodily injury claims resulting from alcohol-related incidents at a wedding.

What is the difference between workers’ compensation insurance and general liability insurance for vendors?

-Workers’ compensation insurance helps businesses pay benefits to their employees, including lost wages if they’re injured on the job. The workers, when they accept the coverage, forgo the right to sue their employer. This is different than liability insurance, which covers damages related to injuries and property damage or loss, along with defense for lawsuits against a company.

What is the difference between vendor liability insurance and an event liability policy?

-Ideally, every professional vendor you work with will have liability insurance that covers their business while it provides goods or services for your event. Event liability insurance, instead of insuring each business with ties to your event, specifically covers your event.